Commercial and Industrial Loans. There is no hiding it our economy is in deep unprecedented recession territory.

If The Fed Believes The Economy Is About To Fall Into Recession It Should - If you're searching for video and picture information linked to the key word you've come to visit the ideal site. Our site provides you with suggestions for viewing the highest quality video and picture content, search and find more informative video articles and images that match your interests. comprises one of thousands of video collections from several sources, especially Youtube, therefore we recommend this video for you to view. You can also bring about supporting this site by sharing videos and graphics that you like on this site on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information that you get on this website. This blog is for them to visit this site.

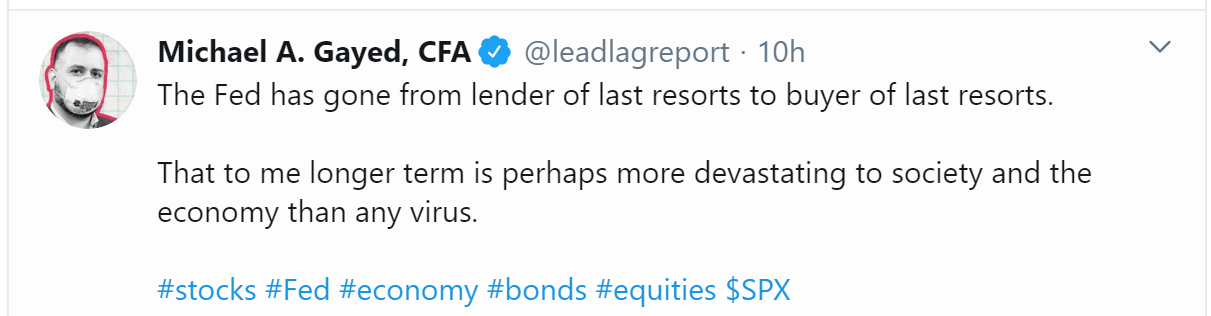

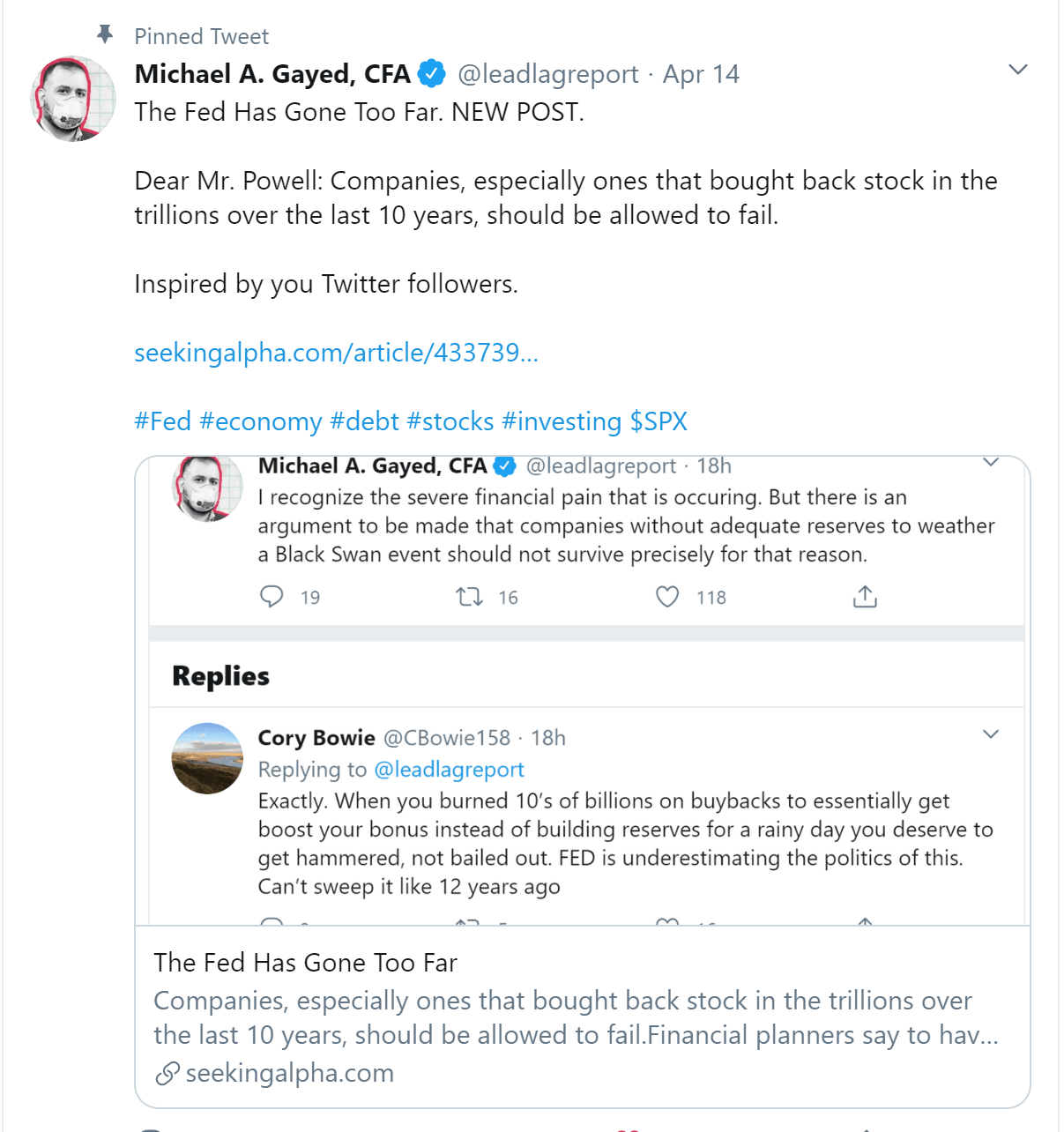

The Fed Is Now A Buyer Of Last Resort And The Implications Are Huge Seeking Alpha

Lets take a look at some numbers.

If the fed believes the economy is about to fall into recession it should. The Great Recession during the late 2000s was preceded by an overheating economy. Fed officials do not envision raising rates further anytime soon and there are signals in financial markets suggesting that if they did raise rates much above current levels the economy could. To avoid recession and the resultant unemployment the Fed must lower the fed funds rate and increase the money supply.

If inflation is low the Fed will have flexibility to lessen the impact of recessions. On its own it might have caused a weak recession but little more. The residential real estate market across most of the country will stay solid supporting house prices.

1 if it causes inflation to rise. Rather we try to invest in companies that can thrive and prosper through a wide range of economic conditions including recessions. The Feds pause will turn out to be a mistake if it creates harm in two ways.

Indeed several yield curve-based models continue to suggest that the US and hence most likely the global economy could fall into recession any time between late 2019 and early 2021. Assume that a hypothetical economy with an mpc of 08 is experiencing severe recession. In an effort to stimulate bank lending and thus the economy the Fed launched a massive QE program that lowered interest rates and crammed money into banks.

A healthy consumer balance sheet is another force that should prevent recession. In addition we have noticed in recent months a growing discord between those in the more bullish and bearish camps and this is evident within our own macro research team as well. Use an expansionary fiscal policy to increase the interest rate and shift AD to the right.

The primary job of the Federal Reserve is to control inflation while avoiding a recession. Oil prices have shot up ahead of nearly every post-war recession. Yet the housing crisis was a distraction.

Use an expansionary monetary policy to lower. To control inflation the Fed must use contractionary monetary policy to slow economic growth. Asset bubbles swelled before the two most.

This is known as contractionary monetary policy. During a recession unemployment rises and prices sometimes fall in a process known as deflation. When inflation is the fed aims to slow the economy.

Advance estimates for Q2 2020 indicated that the economy contracted a whopping 412. However the Fed must be careful not to tip the economy into recession. 599 Billion Bank Loans and Leases.

So to save economy from recession FED will reduce the market interest rate o view the full answer. To help us navigate the uncharted waters let us take a closer look at recessions and what they really are. The unemployment rate continuously fell until 2007 culminating at a.

AskedMar 3in Otherby manish56-34883points 0votes. If the Fed believes the economy is about to fall into recession it should use an expansionary monetary policy to lower the interest rate and shift AD to the right If the Fed believes the inflation rate is about to increase it should. According to the St.

If economy is about to fall into recession that means production of economy will be decreased in future. And 2 if interest rates stay near zero the Fed is deprived of its ability to reduce rates to help us climb out of the next recession. The Fed believes that a slowdown is happening and a recession is likely.

AskedApr 24in Otherby gaurav96-16373points 0votes. If the Fed believes the economy is about to fall Into recession it should use its judgment to do nothing and let the economy make the self adjustment back to potential GDP. Year on year the economy has shrank by 126.

The ideal economic growth rate is between 2-3. Use a contractionary monetary policy to lower the interest rate and shift AD to the left. The Fed in the case of steep economic downturns may.

What is a Recession. The real cause of the Great Recession lay not in the housing market but in the misguided monetary policy of the Federal Reserve. The Fed reduces inflation by raising the federal funds rate or decreasing the money supply.

If the Fed has to quickly pump the brakes on inflation by raising interest rates it could halt further economic growth and thrust the US. It does this with monetary policy. Louis Fed this is what usually happens before a recession.

But it predicts that the turmoil will pass quickly in a matter of months not years. Into yet another recession. As the economy began to collapse in 2008 the Fed focused on solving the housing crisis.

Why Janet Yellen Is Betting On A Comeback For Inflation Comebacks Confidence Janet Yellen

Fed Policy Changes Could Be Coming In Response To Bond Market Turmoil Economists Say

Fed Chairman Powell Says Economic Reopening Could Cause Inflation To Pick Up Temporarily

Federal Reserve Cuts Interest Rates To Prop Up The U S Economy Npr

The Fed Is Now A Buyer Of Last Resort And The Implications Are Huge Seeking Alpha

Biden Wants The Fed To Help Close Racial Economic Gaps How Would That Work Npr

The Blindly Optimistic Fed Self Confidently Confuses Economic Security With Financial Instability Seeking Alpha In 2021 Optimistic Financial Self

Get Ready For Negative Interest Rates When Next Recession Hits

2021 July Fomc Meeting Preview The Fed Meets At An Anxious Time Forbes Advisor