This index measures stock performance of the 500 largest. Yes interest rates would fall because stocks would have a relatively higher rate of return than bonds which would reduce the demand for bonds O B.

Will There Be An Effect On Interest Rates If Brokerage Commissions On Stocks Fall - If you're looking for video and picture information related to the key word you have come to visit the right blog. Our website gives you hints for viewing the highest quality video and image content, hunt and locate more informative video content and graphics that fit your interests. comprises one of thousands of movie collections from several sources, particularly Youtube, so we recommend this video that you see. This blog is for them to stop by this website.

Economics Of Money Chapter 5 Flashcards Easy Notecards

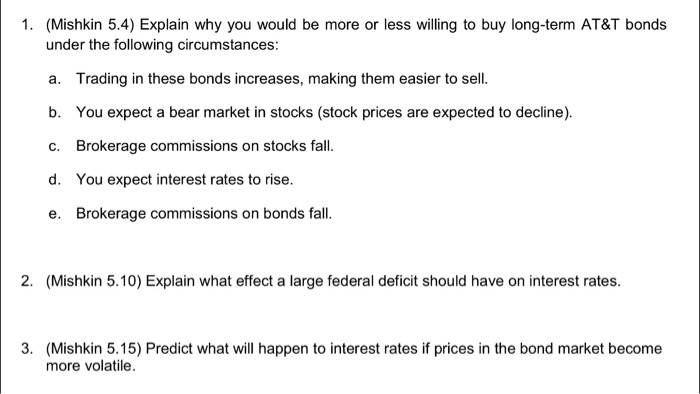

Brokerage commissions on bonds fall 2.

Will there be an effect on interest rates if brokerage commissions on stocks fall. There would be an increase in the rates of interest. As a result the demand for bonds declines the bond price declines and interest rates increase. As rates rise or fall they affect the appropriate valuations for different stocks in different ways.

Yes interest rates will rise. If the commission on stocks reduces it would make the stocks more liquid compared to bonds leading to reduced demand for bonds. The lower commission on stocks makes them more liquid relative to bonds and the demand for bonds will fall.

The lower commission on stocks makes them more liquid relative to bonds and the demand for bonds will fall. Will there be an effect on interest rates if brokerage commissions on stocks fall. The curve showing demand would move to the side of the broker causing the bond prices to reduce hence an increase in the rates of interest.

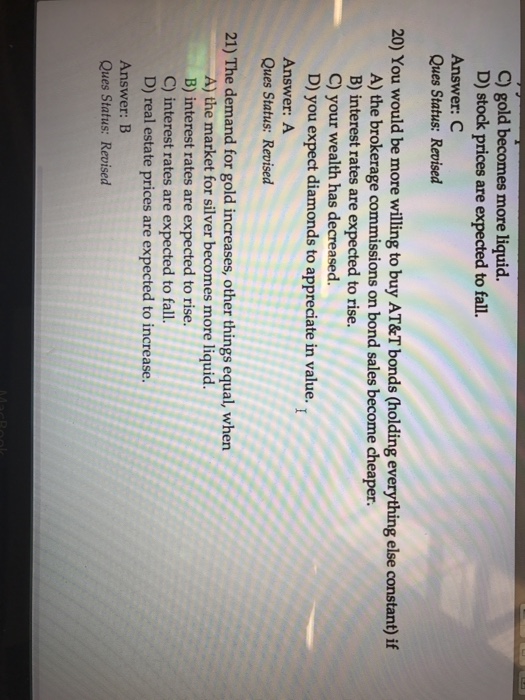

C gold becomes more liquid. Yes interest rates will rise. D interest rates are expected to fall.

D stocks become easier to sell. Will there be an effect on interest rates if brokerage commissions on stocks fall. Will there be an effect on interest rates if brokeragecommissions on stocks fall.

D Brokerage commissions on stocks fall. Thefallinstockbrokeragecommissionmakesstocksmoreattrac-tive relative to bonds. The rates are even lower in IBKR Pro pricing plan 159 for up to 100K balance but that plan comes with trading commissions and inactivity fee that nobody now wants to pay.

As a result bond price will go down and interest rates will go up. The lower commission on stocks makes them more liquid than bonds and the demand for bonds will fall. Any impact on the stock market to a change in the interest rate changes is generally experienced immediately while for the rest of the economy it may.

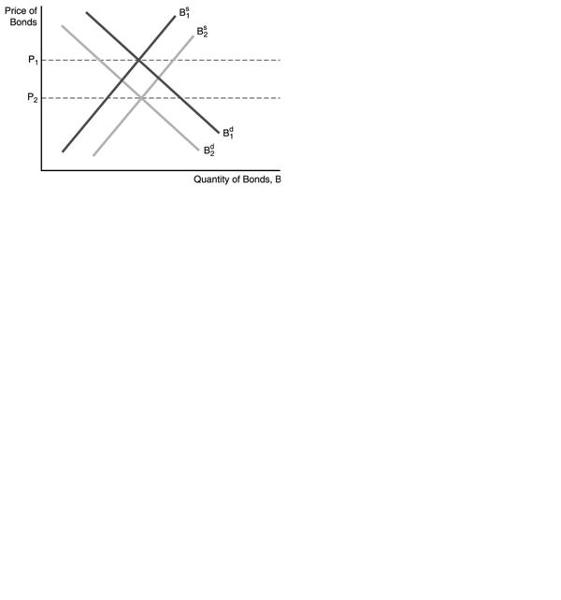

Using a supply and demand analysis for bonds show what effect this action has on interest rates. Lower interest rates make it more attractive to buy assets such as housing. Additionally if your broker doesnt make any sales or buy any stock for you over a certain period of time you could be charged an inactivity fee.

B you expect interest rates to fall. Lower mortgage interest payments. There would be an increase in the rates of interest.

As you can see below Interactive Brokers offers the third lowest margin interest rates of just 26 on all balances in its IBKR Lite pricing plan which comes with 0 commissions on stocks and ETFs. Will there be an effect on interest rates if brokerage commissions on stocks fall. Shifts to the left the equilibrium bond price falls and the interest rate rises.

Will there be an effect on interest rates if brokerage commissions on stocks fall. No interest rates would remain the same because the brokerage commissions would only affect the stock market O C. Interest Rate Effects on Equities.

Question 12 Will there be an effect on interest rates if brokerage commissions on stocks fall. These account transfer fees can add up. If the commission on stocks reduces it would make the stocks more liquid compared to bonds.

Some brokers for example charge you a fee if you decide to change investment firms. This will leave householders with more disposable income and should cause a rise in consumer spending. An important way in which the Federal Reserve decreases the money supply is by selling bonds to the public.

A fall in interest rates will reduce the monthly cost of mortgage repayments. An important way in which the Federal Reserve decreases the money. Treasury bonds other things equal if A you inherit 1 million from your Uncle Harry.

Will there be an effect on interest rates if brokerage commissions on stocks fall. Revised 17 You would be less willing to purchase US. The demand curve B d will therefore shift to the left and the equilibrium interest rate will rise.

Stocks listed on the SP 500 index. However do be aware that rising interest rates can have a negative impact on utilities stocks. A-Yes interest rates would rise because stocks become more liquid than before which would reduce the demand for bonds.

Yes interest rates will rise. When it comes to determining a fair value for equities interest rates are an important variable to consider. Yes interest rates would rise because stocks become more liquid than before which would reduce the demand for bonds.

Economics Of Money Chapter 5 Flashcards Easy Notecards

Economics Of Money Chapter 5 Flashcards Easy Notecards

Mutual Fund Vs Exchange Traded Fund Which One Is Better Mutuals Funds Mutual Funds Investing Investing Money

Pin On Golden Parachute

1 Mishkin 5 4 Explain Why You Would Be More Or Chegg Com

Financial Market And Institutions Extra Questions Flashcards Quizlet

The Newbie S 10 Point Guide To Investing Infographic Investing Infographic Investing 10 Points

Economics Of Money Chapter 5 Flashcards Easy Notecards

You Would Be More Willing To Buy At T Bonds Holding Chegg Com